maine excise tax credit

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or by monetary fine of up to 2000 or by both. This calculator is for the renewal registrations of passenger vehicles only.

Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year.

. That now includes buses manufactured 2006 and newer. 2020 - 2022 Tax Alerts. Property Tax Educational Programs.

Cigarette Tobacco Products Instructional Bulletin PDF Other Tobacco Products Tax Declaration PDF Tobacco Notice PDF To view PDF or Word documents you will need the free document readers. Where do I pay the excise tax. By signing this claim for credit of excise tax report the licensee understands that false statements made on this form are punishable by law.

Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen. If you are unable to submit an electronic schedule in Excel format please contact our office at 207-624-9693. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward. Maine Property Tax School Belfast August 1-5 2022 IAAO Course. You must always come to Town Hall first to.

Our office is also staffed to administer and oversee the property tax administration in the unorganized territory. How much is the excise tax. Send a Schedule 2 electronically for each fuel type.

Supports suppliers distributors and traders dealing with indirect excise taxes. Alternate formats can be requested at. Much like a municipal assessors office the division maintains records of all property ownership in the UT and has over 700 UT tax maps.

Please sign and date in. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Like all states Maine sets its own excise tax.

The money is deposited into the highway fund and used for transportation projects in Maine. 4 The fuel excise tax rates in effect on July 1 2009 were not increased on July 1 2010. The Property Tax Division is responsible for annually assessing and collecting property taxes in the UT.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Motor fuel excise tax is a tax per gallon on motor fuel sold at retail in Maine. The State of Maine will reimburse Municipalities for the difference between the excise tax based on the sale price and the Manufacturer Suggested Retail Price MSRP on vehicles that are 1996 or newer and registered for a gross weight of more than 26000 lbs.

SummaryThis bill provides tax incentives to malt liquor brewers to encourage them to increase their employment in Maine and the amount of malt liquor produced in Maine and exported for sale outside of Maine. Excise tax is paid at the local town office where the owner of the vehicle resides. When a vehicle needs to be registered an excise tax is collected prior to the registration.

Alternate formats can be requested at 207 626-8475 or via email. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident or totally junked or abandoned in the same registration year is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of the number of transfers that may be required of the owner or lessee in that registration year.

The same rates remain in effect until June 30 2011. Gallons received tax exempt from sources within Maine. A credit for excise tax paid is taken on line 26.

Gallons imported to Maine tax exempt which were delivered directly to a customer in Maine. Excise Tax Credit Summary Report Rev. Provides a tax credit against the excise taxes imposed on alcohol manufactured and sold in Maine by a brewer equal to 175 per gallon of malt liquor.

Line 4 Gallons Imported Direct to Customer. Property owners would receive an exemption of 25000. Renewable Energy Investment Exemption -This program.

Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. There are 23769 real estate tax accounts and 814 personal property tax accounts maintained by the. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to excise tax.

The bureau shall grant to the wholesale licensee a credit of all state excise tax paid in connection with that sale under the following conditions. In this case the total selling price of your vehicle comes out to 8000. To view PDF or Word documents you will need the free document readers.

16 rows Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90 biodiesel fuel by volume. Excise Tax Credit Summary Report. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle.

Knowingly supplying false information on this form is a Class D Offense under Maines Criminal Code punishable by confinement of up to one year or by monetary fine of up to 2000 or by both. I have entered this info in Federal Taxes under deductions and credits. Maine Property Tax Institute online - May17-18 2022 Registration.

Maine residents that own a vehicle must pay an excise tax for every year of ownership. When it comes down to Maines sales tax on cars youre only taxed on the 5000 credit not the 13000 you bought it for. 1 The bureau shall grant a credit for the excise tax on malt liquor or wine sold by wholesale licensees to any instrumentality of the United States or any Maine National Guard state training site exempted by the bureau.

The tax is included in the price of every gallon sold to consumers in Maine. Line 3 Gallons Received Tax Unpaid.

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

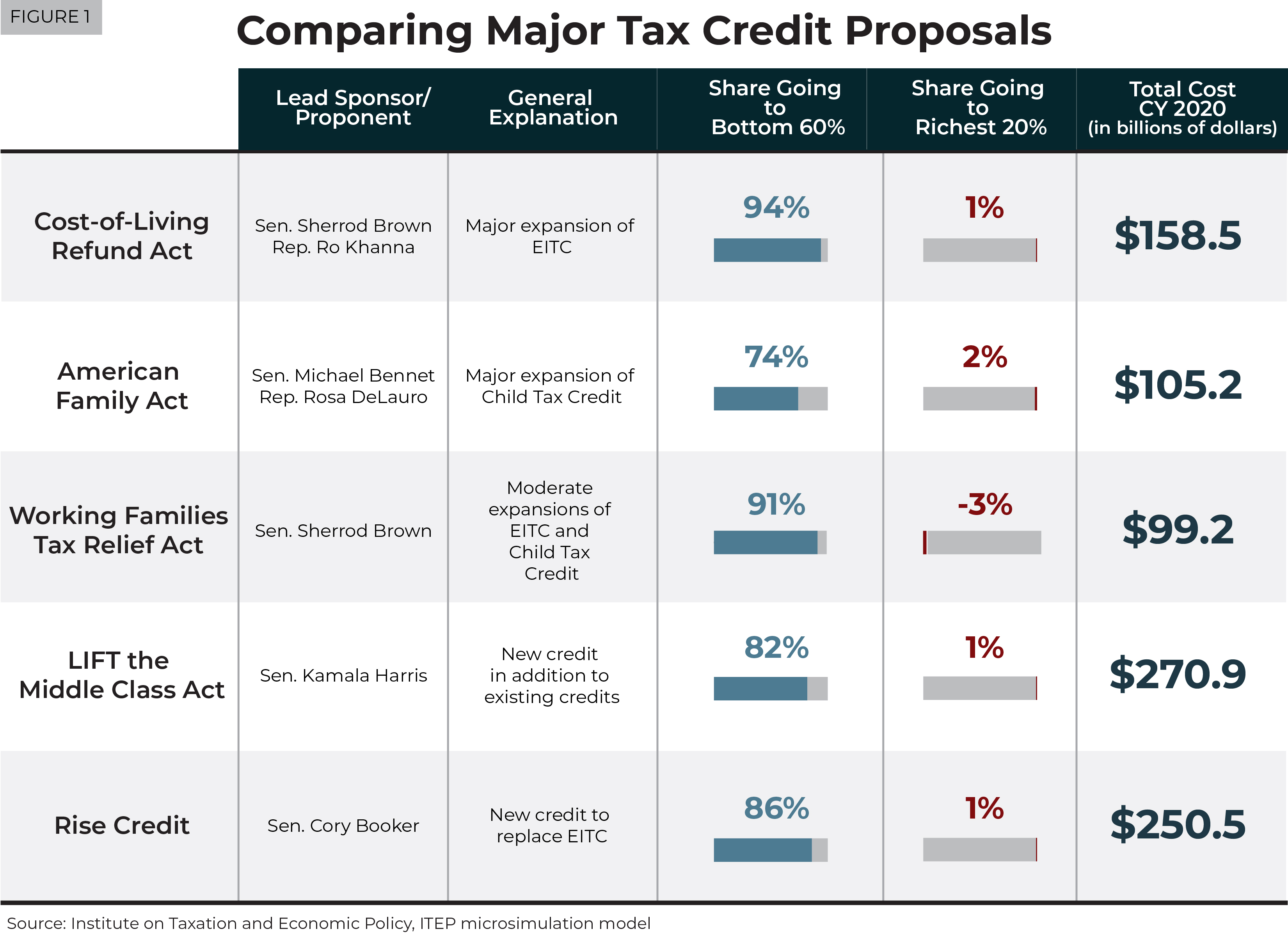

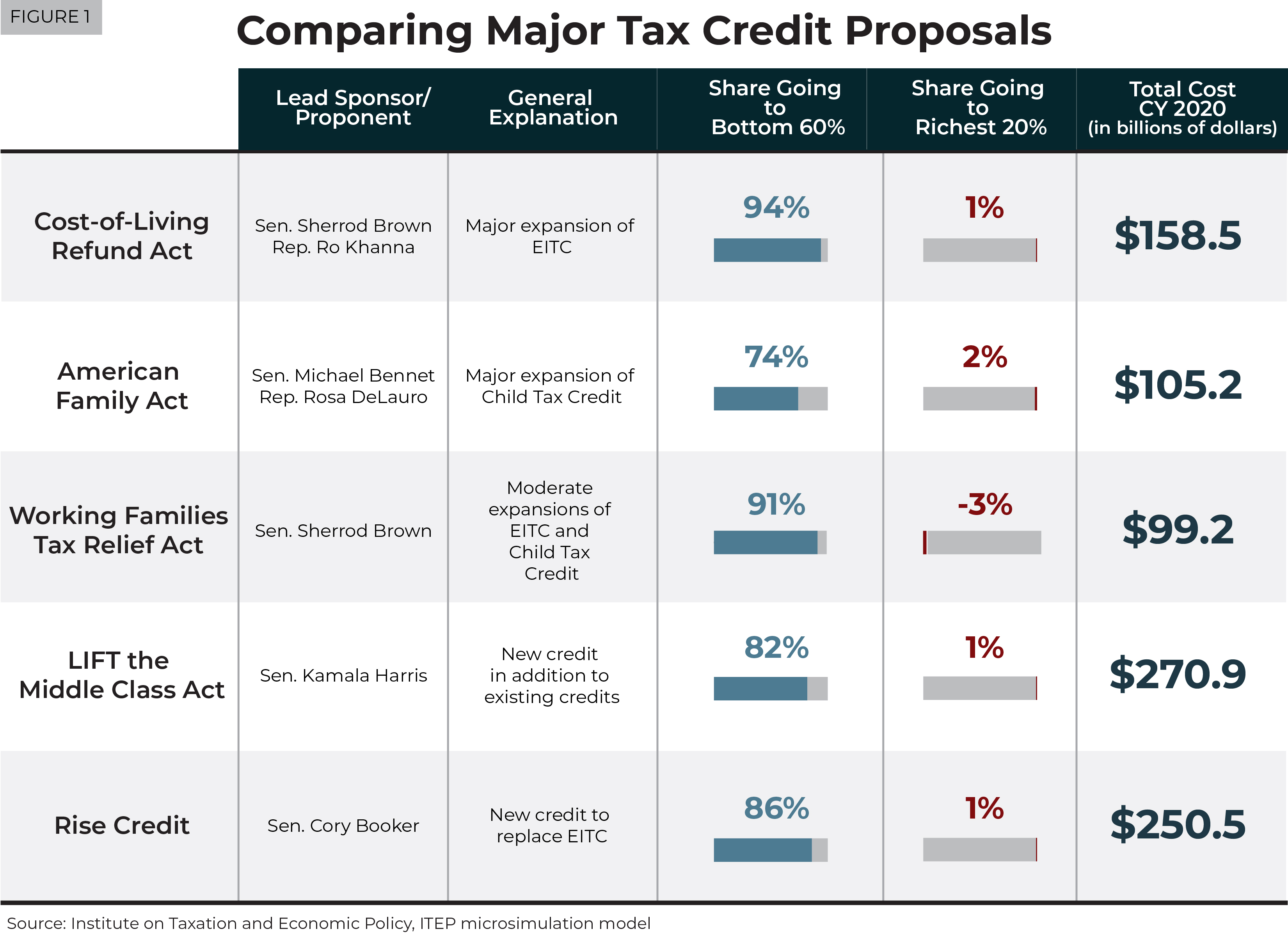

Julian Castro Provides The Latest Proposal To Expand Refundable Tax Credits Itep

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

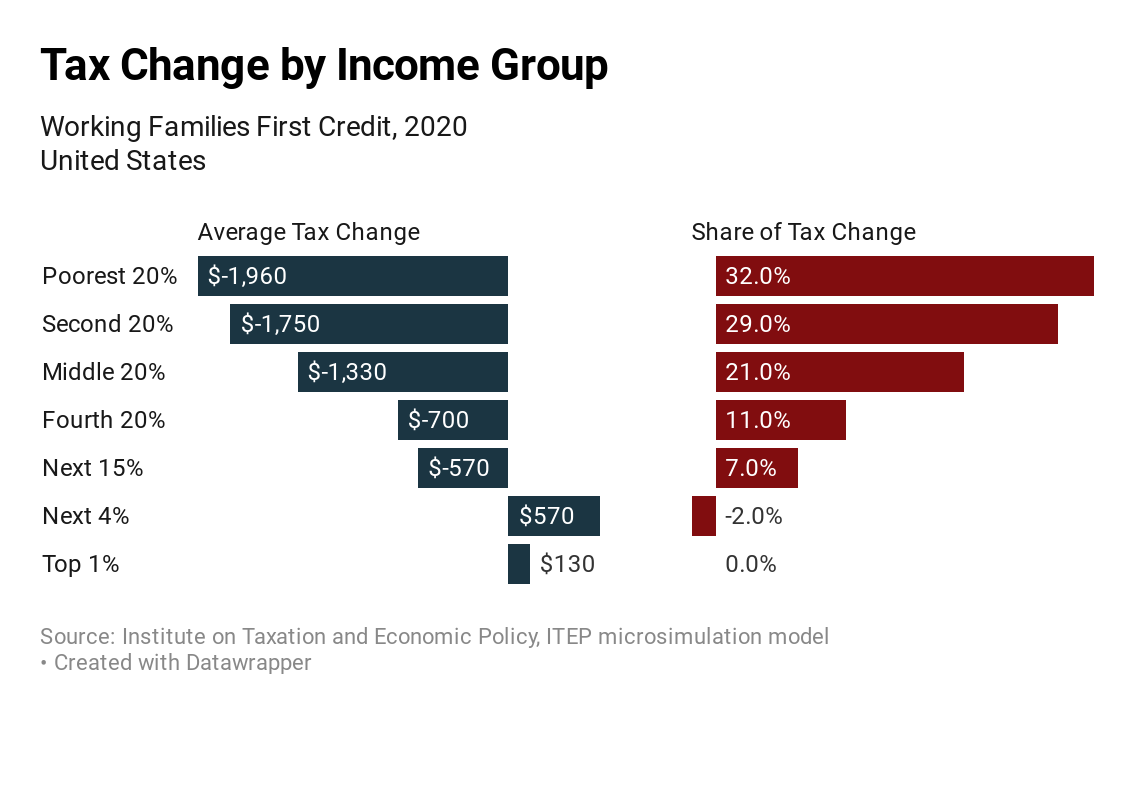

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

Disabled Veterans Property Tax Exemptions By State

Proposals For Refundable Tax Credits Are Light Years From Tax Policies Enacted In Recent Years Itep

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

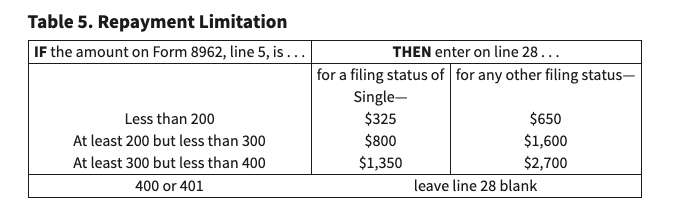

Advanced Tax Credit Repayment Limits

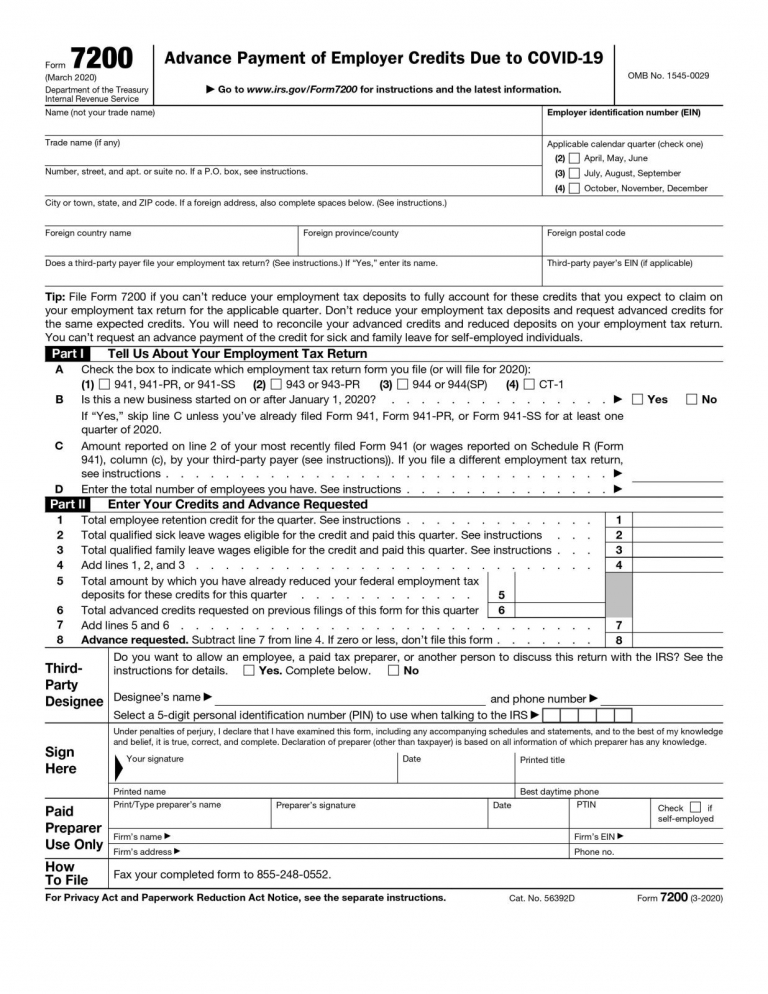

Irs Issues Form 7200 Albin Randall And Bennett

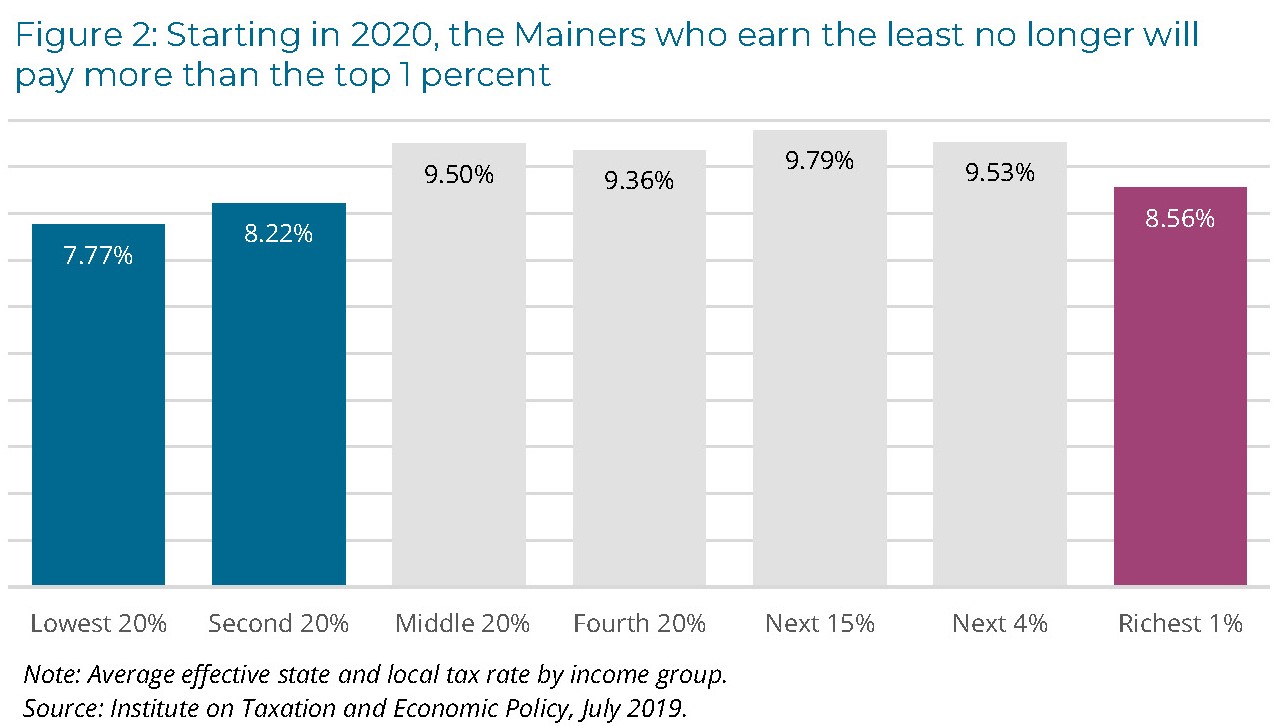

Maine Reaches Tax Fairness Milestone Itep

Sales And Use Tax Regulations Article 3

The Problem With Returning To A 2 000 Non Refundable Child Tax Credit Itep

How Do State Earned Income Tax Credits Work Tax Policy Center

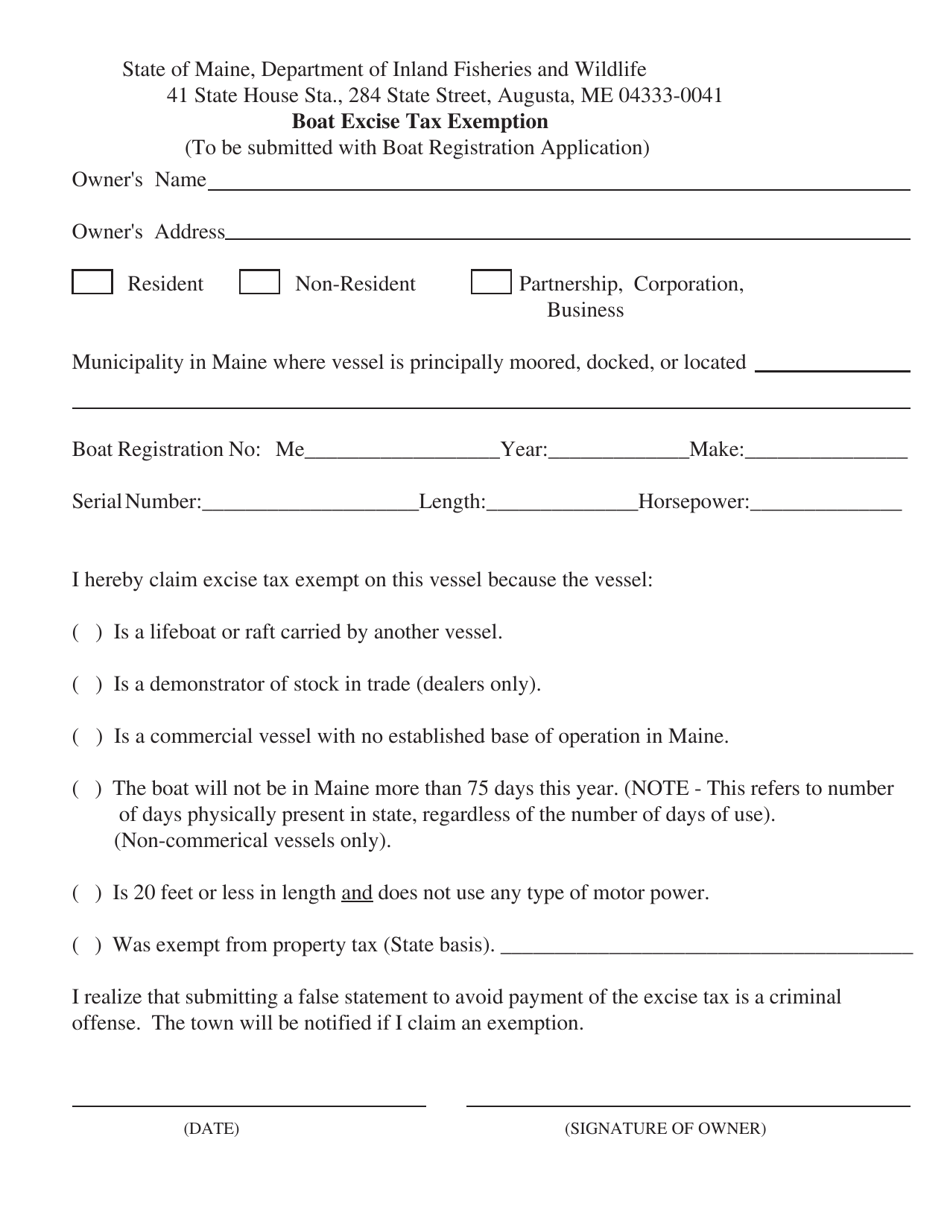

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Breaking Down The Craft Beverage Modernization And Tax Reform Act Blue Label Packaging Company

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

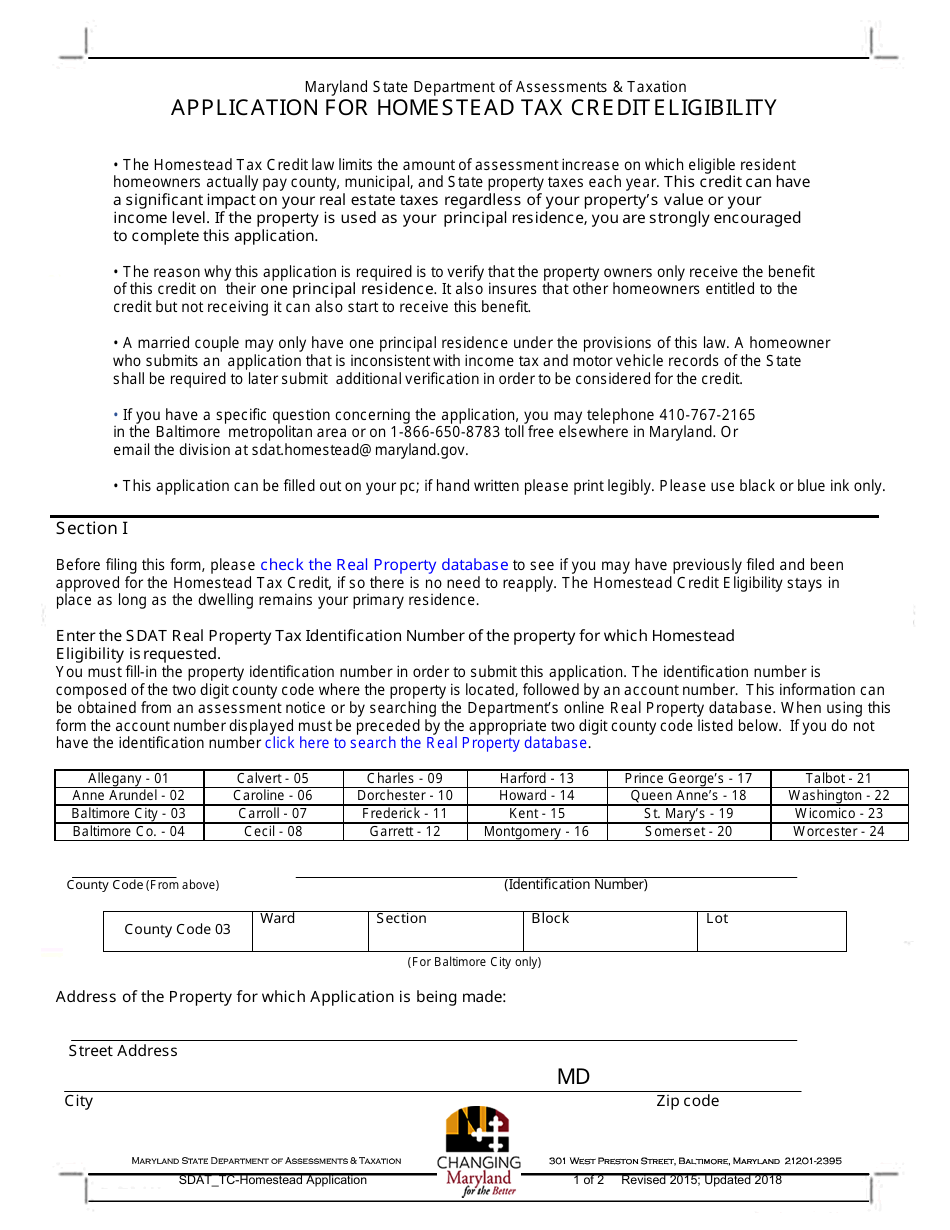

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller